Nominating and Corporate Governance Committee will generally poll the Board members and members of management for recommendations. The Nominating and Corporate Governance Committee may also review the composition and qualification of the boards of directors of VAALCO’s peer group and competitors and may seek input from industry experts or analysts. The Nominating and Corporate Governance Committee then reviews the qualifications, experience and background of the candidates. Final candidates are interviewed by the independent directors and executive management. In making its determinations, the Nominating and Corporate Governance Committee evaluates each individual in the context of the Board as a whole, with the objective of assembling a group with diverse backgrounds that can best represent stockholder interests through the exercise of sound judgment. After review and deliberation of all feedback and data, the Nominating and Corporate Governance Committee makes its recommendation to the Board of Directors. The Nominating and Corporate Governance Committee mayhas in the future choose to engagepast engaged third-party search firms in situations where particular qualifications are required or where existing contacts are not sufficient to identify an appropriate candidate.

Stockholder Recommendation of Director Candidates. The Nominating and Corporate Governance Committee considers all candidates recommended by our stockholders in accordance with the advance notice provisions of our Bylaw provisions.bylaws. Stockholders may recommend candidates by writing to the Corporate Secretary at VAALCO Energy, Inc., 9800 Richmond Avenue, Suite 700, Houston, Texas 77042, stating the recommended candidate’s name and qualifications for Board membership.membership and otherwise providing all of the information required by the advance notice provisions in our bylaws, as well as complying with the deadlines and timelines specified therein. When considering candidates recommended by stockholders, the Nominating and Corporate Governance Committee follows the same Board membership qualifications evaluation and nomination procedures discussed above.

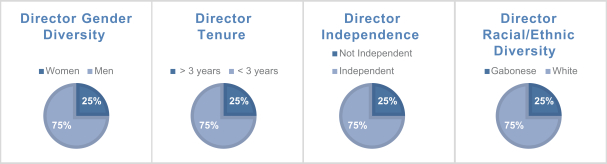

Below we identify and describe the key experience, qualifications and skills our directors bring to the Board that are important in light of VAALCO’s businesses and structure. The directors’ experiences, qualifications and skills that the Board considered in their re-nomination are included in their individual biographies.

Changes in Directors During 2015

On June 3, 2015, effective immediately after the 2015 Annual Meeting, W. Russell Scheirman retired from the Board and as our President and Chief Operating Officer. Mr. Scheirman continued to work for us as a consultant until December 31, 2015. For a description of the consulting agreement we entered into with Mr. Scheirman, please read “Consulting Agreement with Mr. Scheirman” on page 28. The Board determined that, effective immediately following Mr. Scheirman’s retirement from the Board, the size of the Board would be reduced from seven members to six members.

Steven J. Pully was appointed to the Board on July 31, 2015 and at that time the Board determined that the size of the Board would be increased to seven.

On December 22, 2015, the Company entered into a settlement agreement (the “Settlement Agreement”) with Group 42, Inc., a Delaware corporation, Paul A. Bell, Michael Keane (collectively, “Group 42”), and BLR Partners LP, a Texas limited partnership, BLRPart, LP, a Texas limited partnership, BLRGP Inc., a Texas corporation, Fondren Management, LP, a Texas limited partnership, FMLP Inc., a Texas corporation, The Radoff Family Foundation, a Texas non-profit corporation and Bradley L. Radoff (collectively, the “BLR Group” and, together with Group 42, the “Group 42-BLR Group”). Under the terms of the Settlement Agreement, the Group 42-BLR Group agreed to withdraw its consent solicitation to remove a majority of the Board.

In accordance with the Settlement Agreement, James B. Jennings and O. Donaldson Chapoton retired from the Board and the Board appointed Mr. Keane of the Group 42-BLR Group to the Board as the designee of the Group 42-BLR Group on December 22, 2015. Under the Settlement Agreement, Mr. Keane was also appointed as Vice Chairman of the Board and to each of the Our Nominating and Corporate Governance Committee andhas not established a minimum number of shares of common stock that a stockholder must own, or a minimum length of time during which the Compensation Committee.

In the Settlement Agreement, the Board further agreedstockholder must own its shares of common stock, in order to nominate an independent, mutually agreed-upon, designee (the “Mutual Designee”) for election at the 2016 Annual Meeting. The Board agreed to limit the size of the Board to no more than seven directors until the 2016 Annual Meeting, at which time its size could increase to no more than eight directors. However, the Board and the Group 42-BLR Group have not yet identified a Mutual Designee and are continuing a search to identify a candidate acceptable to both the Board and the Group 42-BLR Group. The Company expects that any Mutual Designee will not be appointed to the Board until after the 2016 Annual Meeting.

Moreover, pursuant to the Settlement Agreement, the Board agreed to separate the roles of Chairman of the Board and Chief Executive Officer, with Andrew Fawthrop serving as the new Chairman of the Board. Steven P. Guidry remainsrecommend a director and the Company’s Chief Executive Officer. For a description of the Settlement Agreement, please read “Settlement Agreement with Group 42-BLR Group” on page 36.candidate for consideration.

On December 22, 2015, the Company also entered into a stockholder agreement (the “Stockholder Agreement”) with Kornitzer Capital Management, Inc., a Kansas corporation (“Kornitzer Capital”) and John C. Kornitzer (collectively, “Kornitzer”).

In accordance with the Stockholder Agreement, effective immediately, the Board appointed A. John Knapp, Jr. to the Board. For a description of the Stockholder Agreement, please read “Stockholder Agreement with Kornitzer” on page 36.

The Board of Directors unanimously recommends that stockholders vote FOR the election of each of the nominees.

DIRECTORS AND EXECUTIVE OFFICERS

The following table provides information with respect to current directors, nominees and executive officers of VAALCO. Each nominated director will be elected to serve until the next annual meeting of stockholders or until his successor is elected and qualified.

Name | | Age | | Title |

Andrew L. Fawthrop | | 63 | | Director and Chairman of the Board |

Steven P. Guidry | | 58 | | Director and Chief Executive Officer |

Michael Keane | | 55 | | Director and Vice Chairman of the Board |

Frederick W. Brazelton | | 45 | | Director |

A. John Knapp, Jr. | | 64 | | Director |

John J. Myers, Jr. | | 58 | | Director |

Steven J. Pully | | 56 | | Director |

Cary Bounds | | 48 | | Chief Operating Officer |

Eric J. Christ | | 36 | | Vice President, General Counsel and Corporate Secretary |

Don O. McCormack | | 54 | | Chief Financial Officer |

The following is a brief description of the background and principal occupation of each director (including each nominee) and executive officer:

Andrew L. Fawthrop—Mr. Fawthrop has served on the Board since October 2014 and as the Chairman of the Board since December 2015. Mr. Fawthrop has deep and broad-based experience in the oil and gas industry, including in West Africa, having served for 37 years with Unocal Corporation and Chevron Corporation (following its acquisition of Unocal in 2005) in a vast number of international leadership positions. Most recently, from January 2009 until his retirement in 2014, Mr. Fawthrop served as Chairman and Managing Director for Chevron Nigeria. Prior to his assignment in Nigeria, Mr. Fawthrop served as President and Managing Director for Unocal/Chevron Bangladesh from 2003 until 2007. In his professional career, Mr. Fawthrop held various positions of increasing responsibility for exploration activities around the world in geographies including China, Egypt, Indonesia, South America, Africa, Latin America and Europe. Mr. Fawthrop served as a Member of the Advisory Board of Eurasia Group. He served as a Director of Hindustan Oil Exploration Co. Ltd. from 2003 to 2005. He was an active member of the United States Azerbaijan Chamber of Commerce, the Asia Society of Texas and the Houston World Affairs Council. Mr. Fawthrop holds a Bachelor of Science in Geology and Chemistry and a Masters degree in Marine Geology from the University of London. Mr. Fawthrop’s experience in the international oil and gas industry provides a valuable resource to the Board.

Steven P. Guidry—Mr. Guidry has served as the Company’s Chief Executive Officer since October 2013. At that time, he was also appointed to our Board of Directors and served as the Company’s Chairman of the Board from June 2014 until December 2015. Prior to joining VAALCO, Mr. Guidry was Vice President of Business Development for Marathon Oil Corporation since July 2011, where he was responsible for acquisitions of strategic opportunities for value growth. Mr. Guidry also held numerous executive management positions, including President of Marathon Oil Libya Limited from October 2008 to July 2011. Prior to the Libya assignment, he was regional Vice President for Marathon Oil’s North American Production Operations. Mr. Guidry oversaw all of the company’s exploration and production activities onshore and offshore U.S. He also spent 5 years leading Marathon Oil’s Central Africa Business Unit, overseeing project expansions and operations in Equatorial Guinea, Gabon and Angola. Throughout his career, he held challenging technical, staff and managerial positions in Marathon’s domestic and international production organizations. Mr. Guidry graduated from the University of Louisiana Lafayette in 1980 with a Bachelor of Science in Petroleum Engineering. He is a member of the Society of Petroleum Engineers, and served on the board of directors for the Corporate Council on Africa, the Independent Petroleum Association of America, the U.S. Oil and Gas Association and was a member of the Upstream Committee of the American Petroleum Institute. Mr. Guidry’s strong operational background and experience, particularly in the international arena, is a valuable asset to our Board.

Michael Keane—Mr. Keane has served on the Board and as its Vice Chairman since December 2015. He has over 25 years of experience in business strategy, corporate finance and investment banking. Since 2010, he has served as the Chairman of the Board at Group 42, Inc., a provider of wellbore cleanup chemicals and downhole tools to the oil and gas industry. From July 2010 to August 2012, Mr. Keane was a Senior Vice President for Digital Domain, Inc., a visual effects and digital production company. Previously, Mr. Keane was a Clinical Professor of Finance at the University of Southern California’s Marshall School of Business where he served for more than 10 years teaching courses in investments and corporate finance. He has also been an executive for several NYSE-traded companies and was Managing Director of

Investment Banking for Susquehanna International Group, Seidler Companies, Incorporated, and Kemper Securities, where he specialized in mergers and acquisitions, public offerings and private placements. Mr. Keane holds a J.D. from the University of Texas School of Law and an MBA in Finance from the University of Chicago. Mr. Keane’s knowledge and experience in the international oil and gas industry, capital markets and corporate finance make him a valuable resource to our Board.

Frederick W. Brazelton—Mr. Brazelton has served on the Board since June 2008. Mr. Brazelton is the Co-Founder, President and CEO of Platform Partners, LLC, a private holding company that makes equity investments in middle-market companies. Prior to founding Platform in August 2006, Mr. Brazelton was a Partner of The CapStreet Group, LLC, an institutional private equity fund focused on investing in middle-market companies where he had worked from August 2000 until July 2006. Prior to joining CapStreet, Mr. Brazelton worked for the private equity firms of Hicks, Muse, Tate & Furst and Willis Stein & Partners after starting his career in investment banking at CS First Boston in its Natural Resources Group. Mr. Brazelton serves on the boards of directors of private companies ALM First Holdings, LLC, Encino Energy, LLC, Evergreen Environmental, LLC, Expedition Water Solutions, LLC, Firestone and Robertson Distilling, LLC and Dynamic Glass, LLC. He received his BBA from the Business Honors Program at the University of Texas at Austin and his MBA from Stanford University. Mr. Brazelton’s extensive experience in private equity and finance provides a valuable resource to our Board.

A. John Knapp, Jr.—Mr. Knapp has served on the Board since December 2015. Mr. Knapp is a Partner at CCM Opportunistic Advisors, LLC, an investment fund in Houston Texas, a position he has held since March 2011. He also serves as the President, Chief Executive Officer, and principal stockholder of Andover Group, Inc., a real estate investment and development company he founded in 1978. Mr. Knapp currently serves on the board of directors of ATRM Holdings, Inc. (NASDAQ:ATRM) which he joined in April 2015, and previously served on from January 2013 until March 2013. He also serves as a director of On Track Innovations Ltd. (NASDAQ: OTIV), and has served since December 2012. Previously, Mr. Knapp served as the Chief Executive Officer and a director of ICO, Inc. (NASDAQ: ICOC), from October 2005 to April 2010. Mr. Knapp is a Chartered Financial Analyst and is currently a trustee of Transylvania University in Lexington, Kentucky. Mr. Knapp holds a Bachelor of Arts from Williams College. Mr. Knapp’s prior experience as a chief executive officer of a public company makes him a valuable resource to the Board.

John J. Myers, Jr.—Mr. Myers has served on the Board since March 2010. Mr. Myers was founder and Managing Partner for Treaty Oak Capital Management, an energy investment hedge fund based in Austin, Texas from 2002 through 2009. In 2007, Mr. Myers founded Tectonic Capital Management investment fund, and has also served as an officer of Grace Bay Asset Management LLC since 2014, Cotton Gen LLC since 2014 and Escencial Capital since 2012. Mr. Myers, a Chartered Financial Analyst, was engaged for over 20 years as an equity analyst covering oil and gas exploration and production companies, having served with RBC Dain Rauscher Wessels, Morgan Keegan, Petrie Parkman & Co. and Southcoast Capital. He holds a Bachelors of Science degree in Chemical Engineering from the University of Michigan and a Masters degree in Management from Northwestern University. Mr. Myers’ knowledge and experience in the oil and gas business and the capital markets make him a valuable resource to our Board.

Steven J. Pully—Mr. Pully has served on the Board since July 2015. Mr. Pully has over 30 years of experience in capital markets, finance, investing and legal matters. He also has extensive board participation and leadership experience, having served in a variety of roles on fifteen boards including EPL Oil & Gas, Inc., where he was the lead independent director at the time of the company’s sale. Mr. Pully is currently on the board of Bellatrix Exploration, a public Calgary-based oil and gas producer and Aspire Holdings (formerly Endeavour International), a private North Sea oil and gas producer. From 2008 until 2014, Mr. Pully served as General Counsel and Partner of the investment firm, Carlson Capital, L.P. Mr. Pully previously was an investment banker, serving as a Managing Director in the energy and power investment banking division of Bank of America and as a Senior Managing Director in the natural resources investment banking department of Bear Sterns & Company. Mr. Pully began his career as an attorney with Baker Botts LLP in Houston. Mr. Pully holds a Bachelor of Science in Accounting from Georgetown University and a J.D. from The University of Texas School of Law. Mr. Pully is a Chartered Financial Analyst, a Certified Public Accountant in the State of Texas and a member of the State Bar of Texas. Mr. Pully’s significant experience serving on the boards of exploration and production companies, as well as his capital markets experience, make him a valuable resource to the Board.

Cary Bounds—Mr. Bounds has served as the Company’s Chief Operating Officer since June 2015. Mr. Bounds has held a variety of technical and management positions of increasing responsibility with major energy companies as well as independent E&P companies. Prior to joining the Company, Mr. Bounds was Business Unit Manager and Vice President, Noble Energy Equatorial Guinea Limited from May 2013 until July 2015. Earlier in his tenure with Noble, Mr. Bounds held the position of North Sea Country Manager from April 2010 until May 2013. Prior to Noble, Mr. Bounds was the

Engineering and Planning Manager, Worldwide for Terralliance Technologies, Inc. from 2007 to 2010 and served as their Country Manager in Mozambique from 2007 to 2010. Mr. Bounds was with SM Energy from 2004 to 2007 and held the position of Engineering Manager for their Gulf Coast and Permian regions. Mr. Bounds spent five years with Dominion E&P serving in corporate development, planning and reservoir engineering positions. Mr. Bounds began his career with ConocoPhillips in 1991 where he held a variety of reservoir and production engineering positions in U.S. onshore regions. Mr. Bounds holds a Bachelor of Science Degree in Petroleum Engineering from Texas A&M University.

Eric J. Christ—Mr. Christ has served as our Vice President, General Counsel and Corporate Secretary since January 2015. Prior to joining VAALCO, Mr. Christ served as Vice President, General Counsel and Corporate Secretary of Midstates Petroleum Company, Inc. from November 2013 to January 2015 and as its Assistant Corporate Counsel from September 2012 to November 2013. Prior to Midstates, Mr. Christ served as Associate General Counsel for Transocean Ltd. from October 2010 to September 2012 and practiced corporate and securities law at Vinson & Elkins LLP from 2006 until 2010, where he represented a variety of energy companies. Mr. Christ began his legal career at Porter Hedges LLP in 2005 and holds a Bachelor of Arts, with honors, from Amherst College and a J.D., with honors, from the University of Texas School of Law.

Don O. McCormack—Mr. McCormack has served as our Chief Financial Officer since November 2015. Mr. McCormack most recently served as the Senior Vice President, Treasurer and Chief Accounting Officer for Rosetta Resources, Inc. from December 2013 until Noble Energy’s acquisition of Rosetta in June 2015. Mr. McCormack joined Rosetta as Vice President and Treasurer in August 2012. Prior to joining Rosetta, Mr. McCormack served as Vice President and Chief Accounting Officer from 2010 until 2012 for Concho Resources Inc. From 2007 to 2010, he was the Controller and Chief Accounting Officer for Red Oak Capital Management LLC, an oil and gas investment company based in Houston, Texas. Prior to joining Red Oak, Mr. McCormack held various leadership and managerial positions with Burlington and ConocoPhillips from 1989 to 2006. Mr. McCormack received a Bachelor of Business Administration degree in Accounting from The University of Texas at Arlington and is a Certified Public Accountant in the State of Texas.

All executive officers and director nominees of VAALCO are United States citizens.

MEETINGS AND COMMITTEE OF DIRECTORS

The Board has adopted written charters for each of its three standing, regular committees: the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee. The committee charters are available on VAALCO’s website at www.VAALCO.com. Each committee is operated according to the rules of the NYSE. Each member of these committees meets the independence requirements of the NYSE, as applicable to each committee.

Committees and Current Membership | | Committee Functions |

| | | |

Audit (1) | | ● | Selects and reviews the qualifications, performance, and independence of |

Mr. John J. Myers, Jr.(2) (Chairman) | | | the independent registered public accounting firm |

Mr. Frederick W. Brazelton | | ● | Reviews reports of independent and internal auditors |

Mr. Andrew L. Fawthrop | | ● | Reviews and pre-approves the scope and cost of all services (including |

Mr. A. John Knapp, Jr. | | | non-audit services) provided by the independent registered public |

Mr. Steven J. Pully | | | accounting firm |

| | ● | Monitors the effectiveness of the audit process and financial reporting |

| | ● | Reviews the adequacy of financial and operating controls |

| | ● | Monitors the corporate compliance program |

| | ● | Evaluates the effectiveness of the Audit Committee |

| | | |

Compensation | | ● | Approves the salary and other compensation for the CEO |

Mr. Frederick W. Brazelton (Chairman) | | ● | Review and approve salaries and other compensation for executive |

Mr. Andrew L. Fawthrop | | | officers other than the CEO |

Mr. Michael Keane | | ● | Approves and administers VAALCO’s incentive compensation and |

| | | equity-based plans |

| | ● | Prepares the annual report on executive compensation |

| | ● | Evaluates the effectiveness of the Compensation Committee |

| | ● | Authority to retain a compensation consultant |

| | | |

Nominating and Corporate Governance | | ● | Reviews VAALCO’s corporate governance principles and practices and |

Mr. Andrew L. Fawthrop (Chairman) | | | recommends changes as appropriate |

Mr. Michael Keane | | ● | Evaluates the effectiveness of the Board and its committees and director |

Mr. John J. Myers, Jr. | | | recommends changes to improve Board, Board committee and individual |

| | | effectiveness |

| | ● | Assesses the size and composition of the Board |

| | ● | Identifies and recommends prospective director nominees |

| | ● | Periodically reviews and recommends changes as appropriate in the Amended and Restated Certificate of Incorporation, Bylaws and other Board-adopted governance provisions |

(1) | The Board has determined that all members of the Audit Committee are financially literate within the meaning of the NYSE standards. |

(2) | Audit Committee Financial Expert as determined by the Board under SEC regulations. |

In addition, in January 2016, the Board established a Strategic Committee to be the Board’s mechanism for participation in connection with the Company’s evaluation of strategic alternatives. Mr. Keane was appointed the Chairman of the Strategic Committee and Mr. Pully serves as a member. The Strategic Committee is expected to remain in place for the duration of the Company’s evaluation of strategic alternatives.

None of the members of our Compensation Committee are or have been officers or employees of VAALCO or any of its subsidiaries or had during 2015 a relationship requiring disclosure as a related party transaction.

None of our executive officers serves as a member of the Compensation Committee of any other company that has an executive officer serving as a member of our Board of Directors. None of VAALCO’s executive officers serves as a member of the Board of Directors of any other company that has an executive officer serving as a member of VAALCO’s Compensation Committee.

Meetings and Attendance

In 2015, the Board held 11 Board meetings, 11 Audit Committee meetings, 7 Compensation Committee meetings and 7 Nominating and Governance Committee meetings. During 2015, each of our directors attended at least 75% of the meetings of the Board of Directors and the meetings of the committees of the Board of Directors on which that director served at the time. VAALCO does not have a policy on whether directors are required to attend the Annual Meeting, although all of our directors attended the 2015 annual meeting of stockholders and are expected to attend the 2016 Annual Meeting.

Executive sessions of independent directors are held, at a minimum, in conjunction with each quarterly Board meeting. Any non-employee director can request that an executive session be scheduled. The sessions are scheduled and presided over by the Chairman of the Board.

CORPORATE GOVERNACE

Governance Principles

The Board of Directors’ Corporate Governance Principles, which include guidelines for determining director independence and qualifications for directors, are published on VAALCO’s website atwww.VAALCO.com. The website makes available all of VAALCO’s corporate governance materials, including Board committee charters. These materials are also available in print to any stockholder upon request. The Board regularly reviews corporate governance developments and modifies its Governance Principles, committee charters and key practices as warranted.

Board Leadership Structure

Steven P. Guidry became our Chief Executive Officer in 2013 and assumed the role of Chairman of the Board in June 2014. In December 2015, the Board separated the roles of Chief Executive Officer and Chairman of the Board and appointed Andrew L. Fawthrop as Chairman. With his significant experience and working knowledge of the industry and the issues that face VAALCO, our Board believes Mr. Fawthrop is the best person to lead and guide the Board of Directors. Also in December 2015, the Board appointed Michael Keane as Vice Chairman of the Board. The principal responsibilities of the Vice Chairman are to perform the duties of the Chairman in his absences or during any disability or refusal to act and to have and perform such other duties and powers as may from time to time be assigned to him by the Board. We believe this provides a beneficial leadership structure for VAALCO and our stockholders by providing strong leadership from both our management team and Board of Directors.

Board Risk Oversight

While the full Board of Directors, with input from each of its committees, oversees VAALCO’s management of risks, VAALCO’s management team is responsible for the day-to-day risk management process. The Audit Committee reviews with management, as well as internal and external auditors, the Company’s business risk management process, including the adequacy of VAALCO’s overall control environment and controls in selected areas representing significant financial and business risk. The Audit Committee periodically discusses with management its assessment of various risks and considers the impact of risk on our financial position and the adequacy of our risk-related internal controls. Our Compensation Committee also considers risks that could be implicated by our compensation programs, and our Nominating and Corporate Governance Committee annually reviews the effectiveness of our leadership structure. In addition, each of our committees as well as senior management reports regularly to the full Board of Directors.

Director Independence

It is the policy of the Board of Directors that a majority of the members of the Board be independent. The Board has affirmatively determined that, as to each current, non-employee director nominee (Mr. Brazelton, Mr. Fawthrop, Mr. Keane, Mr. Knapp, Mr. Myers and Mr. Pully), no material relationship exists that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director, and that each current, non-employee director and non-employee director nominee qualifies as “independent” according to VAALCO’s Corporate Governance Principles, which comply with the Corporate Governance Rules of the NYSE.

Code of Conduct

VAALCO has adopted a Code of Business Conduct and Ethics for Directors, Officers and Employees. In addition, VAALCO has adopted a Code of Ethics for the Chief Executive Officer and Senior Financial Officers. Both codes are available on VAALCO’s web site at www.VAALCO.com and are available in print upon request. VAALCO has not granted any waivers to these codes. VAALCO intends to post any waivers or amendments to the codes on its web site.

Communicating Concerns to Directors

In order to provide our stockholders and other interested parties with a direct and open line of communication to the Board of Directors, the Board of Directors has adopted procedures for communications to directors. Our stockholders and other interested persons may communicate with the ChairmanChair of our Audit Committee or with our non-employee directors as a group, by written communications addressed in care of Corporate Secretary, VAALCO Energy, Inc., 9800 Richmond Avenue, Suite 700, Houston, Texas 77042.

All communications received in accordance with these procedures will be reviewed initially by our senior management. Senior managementCorporate Secretary who will relay all such communications to the appropriate director or directors unless it is determined that the communication:

| ● | does not relate to our business or affairs or the functioning or constitution of the Board of Directors or any of its committees; |

| | |

| ● | relates to routine or insignificant matters that do not warrant the attention of the Board of Directors; |

| | |

| ● | is an advertisement or other commercial solicitation or communication; |

| | |

| ● | is frivolous or offensive; or |

| | |

| ● | is otherwise not appropriate for delivery to directors. |

does not relate to our business or affairs or the functioning or constitution of the Board of Directors or any of its committees;

relates to routine or insignificant matters that do not warrant the attention of the Board of Directors;

is an advertisement or other commercial solicitation or communication;

is a resume or other form of job inquiry;

is frivolous or offensive; or

is otherwise not appropriate for delivery to directors.

VAALCO ENERGY, INC. 2022 Proxy Statement | 23

Chair of the Board

Chair of the Board